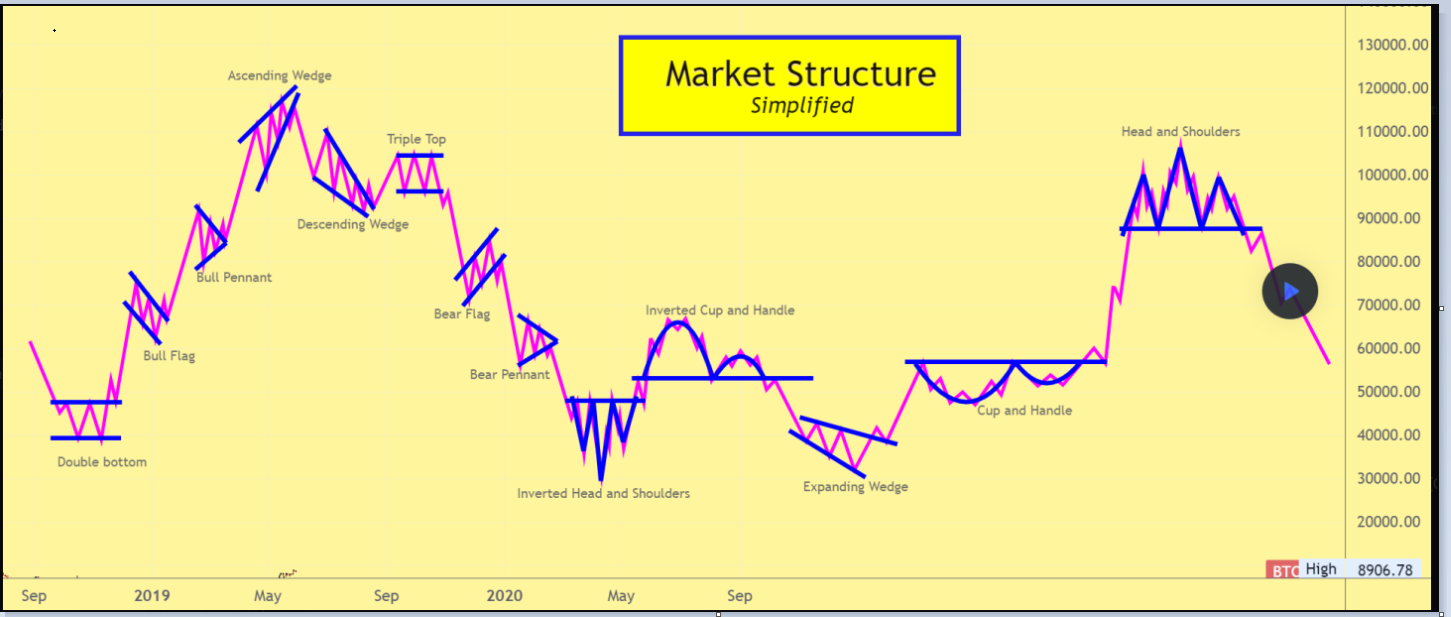

As I always say - no structure, no trade. That must be your priority for now.

YouTube Links To SDT Videos

- How to trade a wedge (placing of stop loss and profit target) and use volume as confirmation (2:14)

- How to trade a wedge (7:20)

- Structural imbalance

- Interpreting candlesticks by combining them

- How much runners should you leave? (1:26)

- Using multiple stops - Buying Channel (20:40)

- Using multiple stops - Head and Shoulders (14:33)

- How to tell if a resistance or support level will hold or break (2:19)

- How a cup forms (2:44)

- Incomplete head and shoulder forms a bull flag (15:03)

- Why does the head and shoulder not work? Spoiler: It’s you(!) Respect the structure (24:40)

- Taking calls of right shoulder support level (8:13)

- Why such a tight stop? Trade structure not P&L (1:47)

- How to tell a stop hunt? (5:54)

- Adding runners (7:13)

- Market doesn’t know where to go (5:54)

- Never fight the trend again

- Never miss massive profit days again

- Explaining flagging (8:55)

- Explaining flagging - Neutral flag (10:30)

- Explaining flagging - Over-extended Flag at HOD (14:40)

- Demand Zone and Reversal Patterns (9:16)

- Use the secret of volume to take profitable trades

- How to profit even when wrong

- Live trading Playlist

- Ultimate price action guide

- How to plan trades with structure

- Learning Structure and risk reward matrics

- Scalping and getting involved

- Adjusting your risks with Delta

Morning Mantra

Pls be patient. Stay focused. 3 trades a day. Not 3 trades an hour.

Let the market present itself. No need to force a trade.

The concept of "missing a trade" does not exist. The market never stops moving and feeding us clues. Stay focused. There's always money to be made. You are never missing out.

Stay focused. Don't get distracted and don't distract.

There's always time to review and vent. Take a breather if you need to. We are all here for each other.

Share your trades. You're never trading alone. We can only come out victorious if we work as a team. Stay focused.

Stay focused. Be disciplined. Be victorious in your rules and discipline. No silly mistakes. Stay disciplined and focused, otherwise, call it an early day if you need to.

Grab a cuppa, let's get ready.

No need to force trades. There's always profits ahead to find. Stay focused, be patient. Good habits and strong focus.

No silly mistakes. Be patient. Stay focused. No trades, no loss. No structure, no trade.

Be the shopper, not a scavenger. Only take trades that you like and can see good R:R. You are the shopper. You are in control. Stay in control. Shop only what you like. Don't be looking for scraps and give yourself unnecessary stress.

Let the market present itself to you where it wants to go. No need to rush and force trades first thing in the morning. Today you're gonna be profitable because:

How I'll make money today

Take Trades...

You were finding profits in the charts and not worrying about where the chart is going. Where it goes is immaterial. It doesn't matter to you. You are concerned with the profits in the charts.

And that entails with just finding 3 good trades a day. That's on average 2 hours per trade. Are you waiting long enough to prepare? Be patient and stay focused.

The more you trade, the more you will lose. That's just how trading works. You have lost by default as you enter a trade (that's the idea of a stop loss and commissions paid).

Your mind will play tricks on you - telling you that you missed a trade when the concept does not exist. The market is always feeding us clues for the next trade and the market is opened every day for the rest of your life. What missed trade?

Or your mind will tell you that you're not good enough because you missed something, and coping mechanisms to compensate for your insecurities in greed and fear will kick in and affect your decision making.

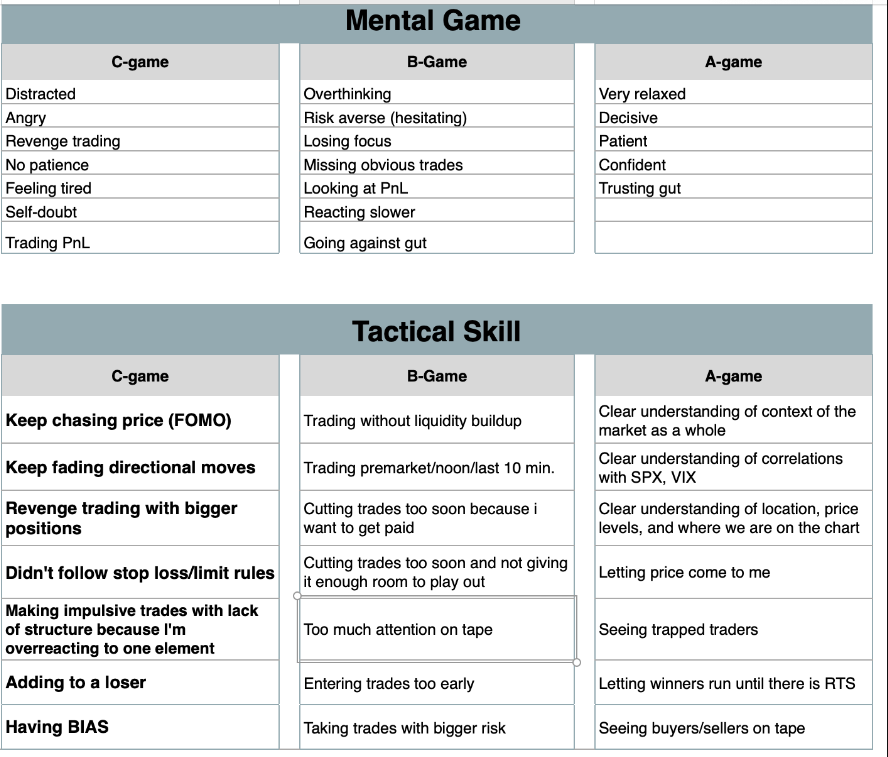

This is why we must rigorously practice and develop rules. You will not rise to the occasion. You will fall back to the level of your training. And this is the best way to cope with negative, even supposedly positive (cockiness) emotions (or just emotions in general.

FIND PROFITS IN THE CHARTS AND TRADE LIKE A MACHINE.

Trading Guidelines

- Don't get swayed by the candles. Train your eyes to see the algos When you do - you will take calls on red candles and puts on green candles and your life will never be the same again

- Be the shopper, not a scavenger. Only take trades that you like and can see good R:R. You are the shopper. You are in control. Stay in control. Shop only what you like. Don't be looking for scraps and give yourself unnecessary stress.

- Pro tip: To prevent being faked out - focus on finding left shoulder liquidity on channel breaks. If you can't see it. Then scale down or wait for market to build more liquidity. If you are a newer trader. I rather you miss trades than trade blindly. Paper trade and practice. You will get better at this. Ultimately, trade entries are not just based on analysis and structure. It's very much on your risk management and tolerance as well. No one will trade like me. Because my risk tolerance and style is just different. Doesn't mean i'm better. It just means no two traders are the same.

- Prepare ahead - it prevents you from overtrading When you have no idea what to do - you will overtrade. When you have a plan - you're more patient

- If you study my trades, I tend to take calls on red candles and puts on green candles. I just like the idea of getting a good fill. My trades are mostly before channel breaks because I study the volume and I see momentum after establishing structure. There are nuances. But practice and you will get better. It's about familiarizing yourself with the charts and the market temperament.

reasons for a short

Tapering blue algo Broke out of controlled algo (lost control) Break of intraday buying (notice the volume increase on breakout) - 5min engulfing doji - all time favorite.- The novice lament about missing trades because to them - it's mostly luck. They probably won't be able to catch another trade again. They don't trust their skills The good traders don't worry about it. They have the skills to find profits in the charts Embody the right identify when you trade. So even when you miss a trade - what identity do you want to be?

- The trick to catching the trade is to prepare for both sides And trade as structure demands

- No structure, no trade. 3 trades a day. That's all you need.

- I understand "buying on channel breaks" is in fact a thing and normally accompanies microstructure when the buying is split across multiple points in the day and today is sort of a super magnified lens into just one of those channel break buys.

- You have to believe it will work but there has to be a good reason. Break of structure, controlled buying or selling for continuation, break of wedge, double top or bottom. These are good examples but it has to have good momentum in any of these trades. It can’t be just weakly moving in the direction you want it to go it needs to be increasing in momentum. And take the trades with the least resistance against them. I like to say be like water. Flow with the chart not against it. The best trades are when it’s moved too far in one direction and it has to turn around but don’t just jump in when you think it’s gone too far. Wait for the resistance to give up and see some good momentum in your direction.

- Bet last and bet big. Don't be caught in the chop and become liquidity

- Trading can be very enjoyable.

- Stick to your rules.

- Be patient on entries.

- A missed trade is infinitely better than a bad entry and getting stuck.

- Enter stress-free state ASAP. Protect trade ASAP.

- Good trading technique is more important than being in the "right" trade.

- Let the market present itself to you.

- 3 quality trades a day. Be patient for setups. Don't force a trade. No trade = no loss. No need to be stressed about jumping into a trade.

- Market is opened every day. For the rest of your life.

Rules

- Limit your number of trades. Only 4 to 5 QUALITY setups. After 5 trades. Shut down your app. This will limit you to only trade quality setups.

- Take only trades with 1:2 risk-reward ratio structure. If you cannot see a structure (and identify entry and exit), NO TRADE.

- Take partial profits of multiple contracts and adjust stops to protect the trade (i've shown in the risk-reward metric video of how that will increase the risk:reward to 1:30). IN CURRENT MARKET CONDITION: TAKE DECISIVE PROFITS

- Stop-loss of maximum 2 to 4% of account size.

- Stop trades once last trade surpasses average daily profit metric. For beginners 15% profit of your account is enough. Once you reach your profit target or 5 trades a day. STOP. I GUARANTEE YOU WILL LOSE IF YOU CONTINUE TRADING.

- Stop trades once 2 consecutive red trades in a day. THIS IS IMPORTANT Mathematically - you can never lose in the long term with parameters like this guarding your trades. If you get stopped, that's one trade and one red trade in the record for today. Focus on improving your trade setup in future, not today. Take decisive profits.

Quotes and Tips

- Trading is not about being right - it's about managing your risks. If you cannot focus to do that - then don't jeopardize your cash

Perfect Setup

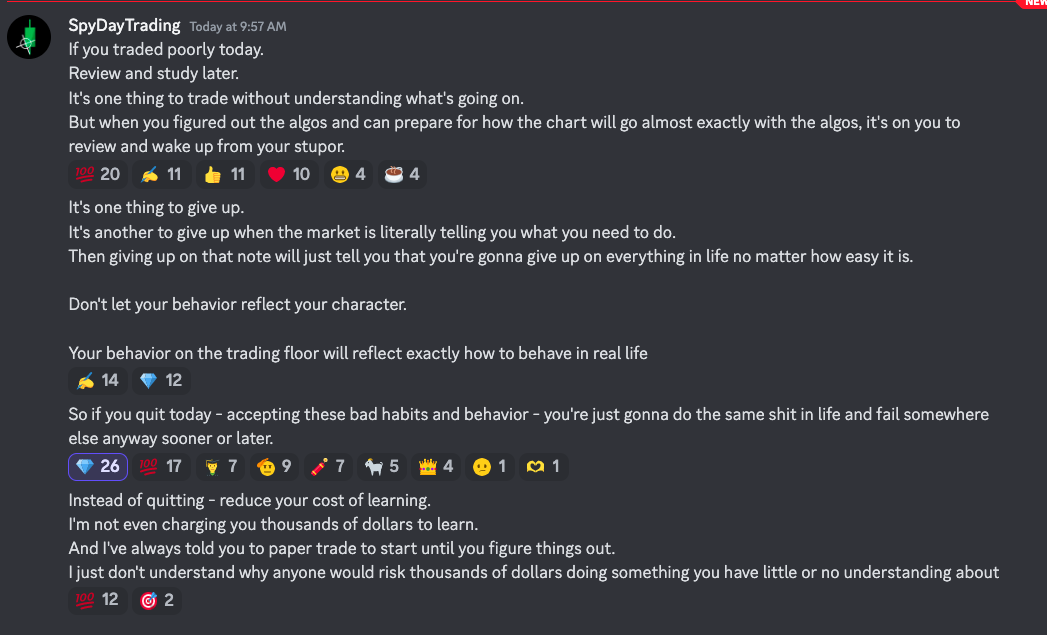

Bad Habits

My experience with those who are dying to call the reversal largely revolve around those who need to recover their earlier losses and thinking there's going to be a dramatic move to do it for them It's a mixture of impatience (can't wait to recover quickly) and greed (thinking the move will irrationally bring in large returns) Dissect your bad habits and eradicate them one by one. But first, you must deconstruct them and know what they are I want you to look at the chart now - and instead of the calls you took. If you were patient and waited for structure, just one trade. Where would you have taken it and would you have recovered? So on that note - you will see that bad habits don't pay. Review your behavior and rationalize it. Big deal if you lost money. convert it into something you can quantify and learn. Make every cent count. Trying to call a reversalKeep reinforcing your bad habits. It's not my money Maybe you get the hero call - if that's what you want then sure, pay for it yourself. You'll get it eventually You're dying to control the market and think you can take a trade at any point of the day That's your ego speaking thinking you have all the information to do and bend the market to your will The market WILL HUMBLE YOU- Where the chart goes matters nothing to us when there is no structure Don't be reinforcing bad habits

- The traders who take profits in AM session stop trading in PM. So the PM session are left with traders trying to recover losses, so they trade more erratically and the big money is designed to gobble them up. This consolidation you see here is one of the better examples. Trap those who are panicking to recovery their losses in the morning to get chopped. One chop at a time and it's tens of millions of profit for institutions. Not to mention the time decay of all those 0DTE options. It's all part of the play.

- "Hello. I used to do the same thing, in fact, quite recently. So you are not alone. It all comes from experience. I started asking myself why I would cut my winners early."

- Don't fight the algos. If we are within the yellow selling algo - don't fight it until at least channel break and some liquidity grab at major levels

- If I don't explain to you how the market works - you will never learn how to manage your risks. It may appear as flip flopping to some of you - but the market is what it is - flip flopping in order to build liquidity. Remember very importantly this that will change your trading: the poor have nothing to lose so they stake it all. That's gambling. The rich have everything to lose so they manage all their risks. So tell me - when you trade, do you want to trade poor, or trade rich? It all starts with your identity. Once you see the algos and structure - you learn to manage your risks. That's what you need to learn. Not just whether the market goes up or goes down.

- "Pls be patient. Stay focused. 3 trades a day. Not 3 trades an hour. Let the market present itself. The concept of 'missing a trade' does not exist. The market never stops moving and feeding us clues."

- You were finding profits in the charts and not worrying about where the chart is going. Where it goes is immaterial. It doesn't matter to you. You are concerned with the profits in the charts.

- And that entails with just finding 3 good trades a day. That's on average 2 hours per trade. Are you waiting long enough to prepare? Be patient and stay focused.

- The more you trade, the more you will lose. That's just how trading works. You have lost by default as you enter a trade (that's the idea of a stop loss and commissions paid).

- Your mind will play tricks on you - telling you that you missed a trade when the concept does not exist. The market is always feeding us clues for the next trade and the market is opened every day for the rest of your life. What missed trade?

- Or your mind will tell you that you're not good enough because you missed something, and coping mechanisms to compensate for your insecurities in greed and fear will kick in and affect your decision making.

- This is why we must rigorously practice and develop rules. You will not rise to the occasion. You will fall back to the level of your training. And this is the best way to cope with negative, even supposedly positive (cockiness) emotions (or just emotions in general.

- Find profits in the charts and trade like a machine. Don't let emotions dictate your next trade.

- "It's tough to get out of bed to do roadwork at 5am when you're sleeping in silk pajamas." - Marvin Hagler

- I will work hard and so must you. Trading is not just talent and skill, but hard work.

"Today you're gonna be profitable because:

Trading Algos

- Trading within controlled algos is no fun. You'll wanna be trading within continuation algos.

- No need to call the reversal, especially on a choppy day. Don't be hope trading. If you have a good reason to do so, manage your own risks. But if you're hope trading - you will know.

- Orange is more bullish because it's a tapered controlled algo. It's a varying algo to build stronger liquidity. Magenta algo tapers into orange algo to rebuild stronger liquidity. So if magenta holds support, it's a good sign.

Reversal Strategy

I only take a reversal when the dominant channel breaks, then a key level of support/resistance breaks, then pulls back. Also have to be at an overbought or oversold level using RSI indicator. You also have to track volume (volume tells a story). And finally make sure what you think is a reversal is not a controlled channel. It’s a list of things to check.

Trading Strategy

When you want to play channel breaks. it's important to identify how the bulls/bears want to grab liquidity on the breakout. This is why it's important to identify a liquidity zone as the right shoulder on the breakout before taking a trade. Otherwise you may find yourself getting faked out often just by playing "channel breaks" without understanding the liquidity grab

Channel Breaks

Go long only if right shoulder is reclaimedI am not an aggressive trader to want to short the top of a buying channel. But I will short a channel break of the intra-day buying channel that is forming a potential H/S. Then I will use the H/S structure to manage my trade as far as SL/TP. Structure is a trade manager, not a trade indicator.

Go long only if right shoulder is reclaimedI am not an aggressive trader to want to short the top of a buying channel. But I will short a channel break of the intra-day buying channel that is forming a potential H/S. Then I will use the H/S structure to manage my trade as far as SL/TP. Structure is a trade manager, not a trade indicator.

Where did the liquidity come from? the left Shoulder of course!

Calls on break of controlled selling channel.

When do we go short? When we see selling continuation. not during controled selling channels, they are for building liquidity.

Eric has shown that when you are seeing a reason for a breakout on a channel, even with structures that seem good like a Head and Shoulders, etc that if you are not seeing a reason for the breakout in terms of there being liquidity to grab then the odds of the trade are much lower. Here is an example from yesterday where the breakout occurs at the right shoulder and it can grab very much liquidity to make a strong downward move. If you did not have all the chop/ small range buying and selling on the left, bears would not have had enough juice to move things down.

Risk Management

It's not about taking a trade - it's about managing your risks. Beginner traders only care about being "right". In the right direction, without understanding the idea of managing risks. If you cannot properly manage your risks in a trade - you are not trading with the intention to scale.

Trading Stages

Stage 1 (1k):

- 1 contract per trade with 20% take profit (protect at 10%)

- At least 1 day to expiration (DTE)

- Max 3 quality trades

- Stoploss per contract: $10 or based on structure, max loss per trade $10

- Profit target: 50

- Loss stop (stop the day if you lose): 50

Stage 2 (2k): After 3 consecutive weeks of profits in Stage 1

- Max 3 or 4 trades

- 20% take profit (protect at 10%)

- Max 2-3 contracts

- Stoploss per contract: $15 or based on structure, max loss per trade $30

- Profit target: 100

- Loss stop (stop the day if you lose): 100

Stage 3 (3k): After 2 weeks of Stage 2

- Add to winners;

- 10% stoploss and 20% take profit (protect at 10%)

- Max 5 contracts - worth up to 100 per contract ($500 per trade)

- Stoploss per contract: $10 or based on structure, max loss per trade $50

- Profit target: 200

- Loss stop (stop the day if you lose): 200

Stage 4 (5k): knowing daily profits and not to overtrade; after 2 weeks of stage 3;

- 10% stoploss and 20% take profit (protect at 10%)

- Max 10 contracts, $1000 per trade

- Stoploss per contract: $10 or based on structure, max loss per trade $100

- Profit target: 300

- Loss stop (stop the day if you lose): 300

Stage 5: Selling Options, Straddle

Stage 6: Own spy stocks and sell options

Never stop learning and never stop sharing what we know - We shall all be successful.